Demystify Cyber Risks

Drawing on our experience as a pioneer in cyber insurance, Chubb Cyber Index provides real-time access to data to benchmark cyber loss and understand the latest cyber threats.

That's Chubb partnership.

Partnership

Solutions

Insights

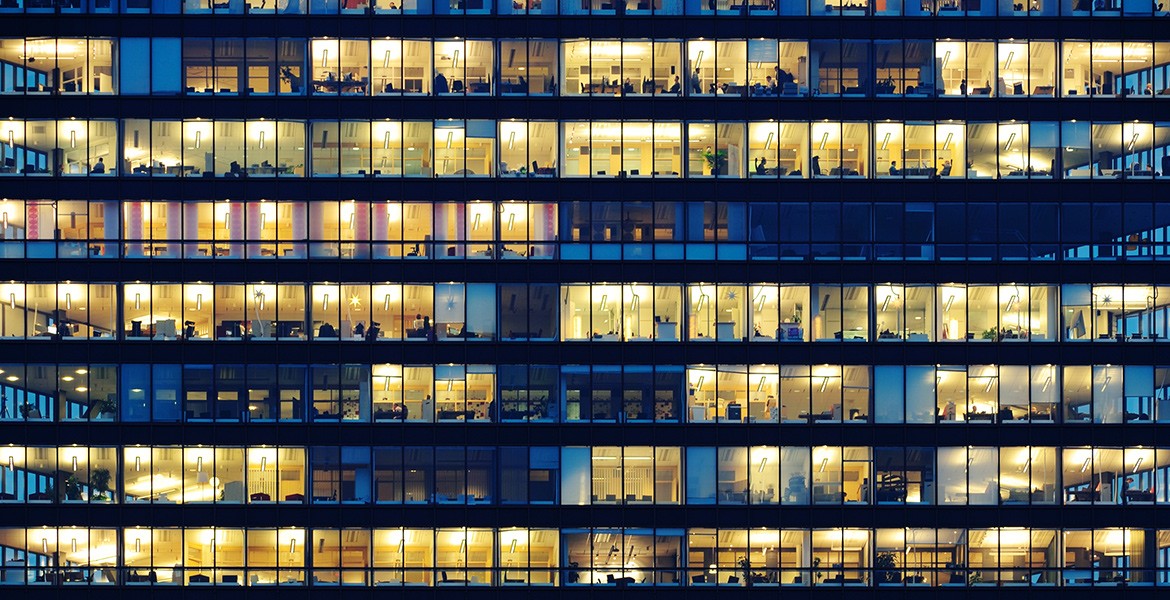

Chubb has a decades-long record of being there for clients, consistently, at every turn, with a steady underwriting appetite, stable capacity and innovative solutions.

More than your insurance carrier, we’re your strategic partner: customizing programs and claims services, enriching programs, executing with excellence—and giving you a technological edge. All the while ensuring, our world-class financial strength, expertise, and stability of Chubb are there for you for years to come.

The Chubb Way

Chubb has the expertise, appetite, and capacity to offer tailored program solutions for large accounts worldwide.

Optimize your Chubb partnership from day one with consistent coverage and capacity, dedicated account management, deep industry-focused expertise, and world-class technologies. Wherever your business goes, Chubb is there in more than 625 offices worldwide, keeping ahead of changing needs, ensuring a holistic approach to our relationship—from underwriting to claims. We even work with you to craft the industry’s next innovations.

Listening, learning and adapting to your needs, we make doing business with Chubb simple. Learn about our personalized, holistic approach.

Chubb’s cutting-edge systems and tools ease and elevate risk management.

Build, manage and ensure your multinational program’s success with Chubb’s consistent, compliant coverage and excellent service.

Our deep industry knowledge, combined with exceptional underwriting, ignites powerful solutions.

Stable Protection, Superior Service.

On the Road: Pairing A&H and Multinational Casualty coverage for comprehensive international travel solutions

Trust Chubb to help you manage virtually any risk worldwide, year after year. Our wide-ranging core & specialty coverages are underwritten with discipline and consistency, ensuring stable capacity to help insulate clients from volatility, while industry-leading services help continually drive down Total Cost of Risk. For the expertise and protection you need, locally and globally, in more than 200 countries, Chubb is there.

Our experience, always working for you.

As one of the leading writers of casualty business, Chubb partnered with Cozen O’Conner to provide expert insight and analysis on liability issues affecting the industry.

A world-leading insurer and true partner, Chubb shares our wealth of data and insights to help you optimize risk management today—and prepare for tomorrow. Whether it’s proprietary data to benchmark liability limits or evaluate cyber threats or timely information to keep you ahead of emerging risks, Chubb has you covered.

Demystify Cyber Risks

Drawing on our experience as a pioneer in cyber insurance, Chubb Cyber Index provides real-time access to data to benchmark cyber loss and understand the latest cyber threats.

Benchmark Liability Limits

Chubb shares important insights into loss cost trends affecting your industry and the median liability limits that were purchased in the Liability Limit Benchmark & Large Loss Profile By Sector 2023 Report.

Simplify Multinational Research

Our Multinational Research Tool within Worldview® answers your questions and keeps you current on legal, regulatory and compliance issues around the globe -- providing information on nearly half a million unique possible issues.

Multinational Policy Translation

Policies issued locally around the world are often written in the local language. Through Worldview®, you can translate these policies to English automatically—and get the coverage insights you need fast.

Risk Control & Consulting Expertise

Chubb Global Risk Advisors customizes solutions to further your risk management, compliance and sustainability goals.

Stay Ahead of Global Risks

Drawing on expertise throughout our worldwide network, Chubb advisories focus on the issues impacting multinational exposures, compliance and coverage now.