At Chubb, we understand the challenges that complex, interconnected risks present for today’s large and multinational organizations. We have been providing globally coordinated, locally flexible insurance solutions for large U.S. and Canadian organizations and their brokers for over three decades.

Chubb specializes in meeting the risk management needs of large U.S. and Canadian-based companies that require tailored and innovative coverage solutions. We have extensive expertise in global underwriting, compliance and regulatory navigation, loss assessment and mitigation, as well as claims handling. We provide devoted support through our coordinated relationship management. We are dedicated to working collaboratively with clients and their brokers to craft and deliver potent solutions through Chubb’s extensive global services and claims operations.

With underwriting centered in Chubb’s eight North American regions and an added local presence in 40 branch offices, our experienced team of underwriting managers, field-based client segment leaders, client executives, claims technicians, and service professionals are fully prepared to develop insurance programs on a global basis to serve the needs of today’s large corporate and institutional marketplace.

Collaborative Approach

Download our brochure to learn more about Chubb North America Major Accounts and how to position this specialized division to work for you.

Core Coverages & Services

- Accident & Health

- Commercial Marine

- Environmental

- Excess Casualty

- Inland Marine

- Management Liability

- Primary Casualty

- Professional Liability

- Property

- Surety

- ESIS®- Risk Management Services and Third Party Administrator

Specialty Coverage

- Builders’ Risk

- Contingent Liability

- Contractor Controlled Insurance Programs, Maintenance Wraps, Owner Controller Insurance Program

- Defense Base Act

- Kidnap & Extortion

- Loss Portfolio Transfers

- Package/Guaranteed Costs as part of a Master Program

- Prospective Deductible Buybacks

- Representations & Warranties

- Run-off/Tail Coverage

- Tax Indemnity

Dedicated Industry Practices

- Construction

- Energy

- Financial Institutions

- Healthcare

- Life Sciences

- Private Equity

- Real Estate & Hospitality

- Transportation

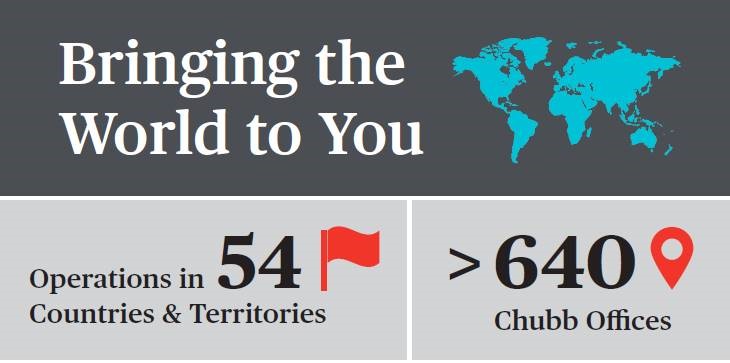

Chubb offers an unparalleled scope of coverage worldwide, including a deep and experienced team dedicated to ensuring smooth operation of each client’s multinational program, locally and globally.

Our multinational programs are backed by the financial strength and resources of Chubb and connected to state-of-the-market technology that keeps customers out ahead of changing market dynamics, everywhere they operate, and elevates all aspects of multinational risk management.

Enhanced Service

Client relationship management: Easier for you

Companies and risk managers today face an increasingly complex array of risks. But for organizations that span geographies, those risks are interconnected and magnified. Our goal is to make managing your insurance program as easy as possible, and we structured the division that way. Our global, multidisciplinary network is dedicated to providing you, your team and your broker with comprehensive support in all areas of your program, at all times. It’s a complete approach that spans borders, lines of business and service areas seamlessly. Our Global Client Executive program helps tie together and support our overall customer relationship management. There’s nothing easy about managing a global insurance program. We just make it easier for you.

Claims relationship management: Coordinated, real time and responsive

Much of what you’ll find in Chubb Major Accounts stems from our ongoing dialogue with clients and their brokers. That’s especially true when it comes to claims. Our claims relationship management for multinational companies is coordinated by senior claims executives at home and abroad. It’s staffed by seasoned claims professionals locally, and supported by consistent protocols and processes globally. Our Claims Business Consultants provide the next level of expertise to help manage your accounts and drive consistency in your program. We put the dialogue on claims where it should be – at the heart of the client relationship, throughout the lifecycle of the insurance contract. And when a claim occurs – wherever it occurs – we’ll manage it consistently and accurately, and we’ll resolve it efficiently.

Global service: Published standards, transparency and accountability

Our Global Services team ensures timely and consistent administration of your program. With leading-edge technology and our expansive network, we manage globally and execute locally. We adhere to demanding performance and delivery standards, so your Chubb experience will always be superior – and consistent – in terms of quality, accuracy and efficiency. Learn More.

Worldview: Technology that transforms Multinational Risk Management

Worldview, our unique and award-winning Web-based platform, puts the status of your entire insurance program at your team’s fingertips – in real time. View program and claims updates, get copies of local policies and certificates, and even access the proprietary research tools our underwriters, account managers, claims teams and legal staff use every day. That’s just a small sample of what Worldview can do. Configure Worldview to get you what you want, when you want it – from e-mail alerts when something happens to a range of custom reports. In short, it’s the most powerful, effective and transparent tool of its kind in the industry, and it’s available exclusively to Chubb clients and their brokers.

Contact

If you have any questions regarding Chubb North America Major Accounts, please feel free to contact your respective Zonal Leader.

Craig Hanrahan

New York

craig.hanrahan@chubb.com

Lisa Humphrey

Western/Pacific

lisa.humphrey@chubb.com

Liability Limit Benchmark & Large Loss Profile by Industry Sector 2023

We developed this annual report over a decade ago, to provide our customers with the data and insights that they need to make informed risk management decisions, long before an unexpected event might occur.