Top Risks for Private Companies in the U.S.

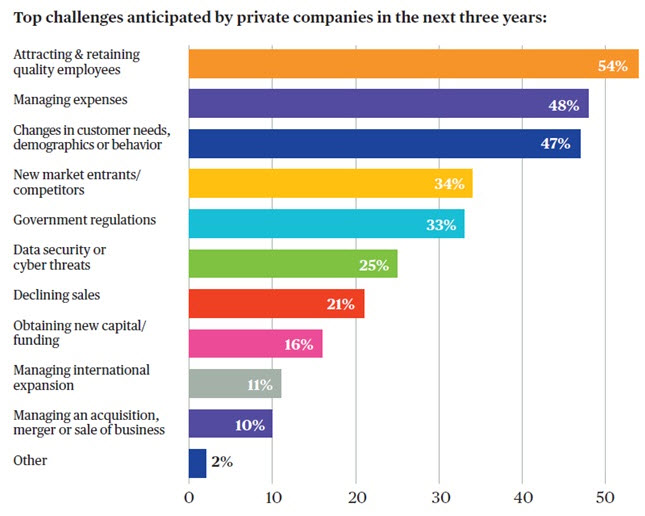

Chubb’s Top Risks for Private Companies in the U.S. is a collection of highlights from Chubb’s most recent Private Company Survey. The book explores the potential liability exposures of private companies and sheds light on one often overlooked risk: the fact that such costly loss events inevitably take key executives away from their primary responsibility of running their business.

Top Risks for Private Companies in the U.S. is a look into the big picture of the risks private company executives face, which may assist them in making wise decisions in the areas of Directors & Officers (D&O) liability, Employment Practices Liability (EPL), cyber liability, and commercial criminal liability insurance.

“Private companies, regardless of size, are threatened by multiple liability and criminal exposures. Liability risks, lawsuits and fines, cyber theft and commercial crime are real threats facing private companies; however, when such a loss occurs, many private organizations overlook the hidden costs associated with those losses.”

Leigh Anne Sherman, EVP, Private/Not-For-Profit Management Liability

Directors & Officers

More than a quarter of participating companies experienced Directors & Officers (D&O) losses during the previous three years, though more than half had not purchased this line of insurance.

Private Companies can help protect themselves from a D&O loss by:

- Broadening perspective

- Formalizing operational structures

- Diversifying Board membership

Employment Practices Liability

EPL claims relating to harassment, bullying, retaliation, and discrimination represent a majority of all management liability related actions. Fortunately, 65% of responding companies indicate they currently purchase EPL insurance.

Private Companies can help protect themselves from an EPL loss by:

- Establishing, maintaining, and consistently following HR policies and procedures

- Training and certifying employees

- Documenting all actions

Cyber

One myth that is common among 85 percent of the executives at small and midsize private companies is that their organizations are not sufficiently large enough to interest cyber criminals. Unfortunately, the opposite is true. 60% of all attacks are against small and midsize companies for that very reason: cyber criminals know these organizations are less likely to have the resources in place to protect themselves with the robust cyber security measures employed by bigger enterprises.

Private Companies can help protect themselves from a loss by:

- Making cyber security a top priority

- Developing an incident response plan

- Vetting third party vendors

Commercial Crime

Private companies are increasingly exposed to substantial losses stemming from internal theft, as employees are inherently trusted with company property, inventory, money, and computer systems as part of running the business.

Private Companies can help protect themselves from loss by:

- Establishing a system of checks and balances

- Monitoring open accounts

- Implementing additional verification processes

“Top Risks for Private Companies in the U.S.” is based on Chubb’s most recent Private Company Survey, which collected information from 600 decision makers in U.S. private companies to ascertain concern about management of corporate risks, uncover risk mitigation strategies and identify the prevalence of insurance ownership.

Interested in Learning More?

Download Top Risks for Private Companies in the U.S. for additional findings relating to D&O, Cyber, EPL, and Commercial Crime coverages.